Comprehending LLCs: A Guide to Limited Responsibility Companies

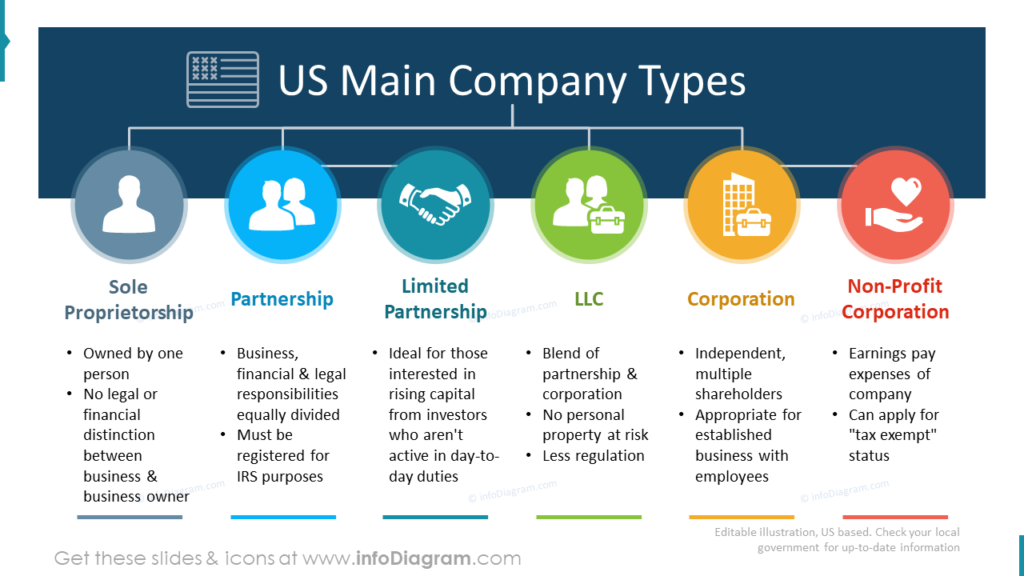

When beginning an organization, selecting the best structure is essential for both legal protections and operational effectiveness. Amongst the different organization frameworks readily available, the Minimal Obligation Company (LLC) stands apart as a popular selection for business owners throughout the USA. An LLC distinctively incorporates the limited responsibility attributes of a firm with the tax obligation effectiveness and operational versatility of a partnership. This structure shields individual properties from organization debts and responsibilities, which implies that individual property, such as a home or automobile, is normally not in jeopardy if the LLC faces personal bankruptcy or suits. Additionally, LLCs are identified by their less rigorous regulatory needs compared to companies, making them an ideal choice for little to medium-sized enterprises.

The advantages of creating an LLC extend past responsibility security to consist of tax benefits. Unlike companies, LLCs enjoy pass-through taxes, where the revenues and losses of the service pass straight to the members (owners) without being subject to company tax obligation prices. This can result in significant tax cost savings, especially for smaller services. LLCs offer a high level of adaptability in management and company operations. They can be taken care of by their members or by a designated team of managers, allowing owners to tailor the administration framework to best fit their requirements. Furthermore, there are no constraints on the number of participants an LLC can have, and members can consist of individuals, companies, other LLCs, and even foreign entities. This flexibility makes LLCs an appealing option for a varied series of service endeavors.

Recognizing the Structure and Advantages of an LLC

A Restricted Obligation Company (LLC) is a popular organization framework in the United States because of its flexibility and beneficial qualities for little to medium-sized enterprises. An LLC distinctly incorporates the features of both a partnership and a company, using individual responsibility security to its owners, that are commonly referred to as members. Generally, these participants can be people, corporations, other LLCs, or even international entities, without maximum restriction on the variety of participants. One of the standout attributes of an LLC is the defense it gives; members are not directly liable for business financial obligations and insurance claims, which implies personal properties like homes, cars, and personal savings account are guarded in the event business sustains debt or faces lawsuits. LLCs are known for their tax obligation versatility. Unlike a conventional corporation, which encounters double taxation when at the company degree and once more on rewards, LLCs appreciate pass-through taxation. This implies that LLCs themselves do not pay tax obligations at the company level. Rather, losses and revenues are passed with to participants, who then report this information on their individual tax returns, thereby avoiding the dual taxation that bigger companies commonly come across. In addition, the functional flexibility of an LLC is especially enticing; it does not need an official framework like a board of supervisors, and the everyday management can be taken care of by the participants or designated managers. This enables a more straightforward governance framework, which can be optimal for smaller sized firms that do not have the sources to take care of intricate company formalities. Additionally, developing an LLC is usually simpler and requires much less documents than forming a corporation. The demands vary by state, yet normally entail filing short articles of company with the state and paying a filing fee. After development, LLCs are simple to maintain with less yearly requirements and formalities compared to firms. This simplicity of development and maintenance makes the LLC an eye-catching choice for numerous business owners and local business owner seeking to incorporate responsibility security with simplicity and tax performance.

Comprehending the Structure and Benefits of an LLC

Limited Responsibility Firms (LLCs) are a prominent selection for entrepreneur seeking flexibility and security. This organization framework distinctly integrates the pass-through taxes of a partnership or single proprietorship with the minimal responsibility of a company, making it an eye-catching choice for lots of entrepreneurs. An LLC is developed by filing the required documents, typically called the Articles of Company, with the suitable state authority and paying the required fees. These fundamental files describe the standard info about the LLC, such as its name, major address, and the names of its members. When developed, an LLC is controlled by an Operating Arrangement, an important paper that specifies the management structure and operational procedures of the firm. This contract is highly personalized, allowing members to tailor business's governance to their specific needs, which can include provisions for decision-making processes, profit sharing, and duties of the members. The versatility provided by an LLC expands not only to its administration yet additionally to its ability to adjust to adjustments in possession and company extent without too numerous statutory restrictions. Among the prime benefits of an LLC is the restricted liability protection it uses. Participants of an LLC are typically not directly liable for the business's obligations and debts. This defense is vital, as it allows business owners to take risks without the fear of losing individual possessions. In addition, LLCs appreciate a less inflexible operational framework contrasted to companies, which are bound by even more procedures such as holding annual meetings and preserving thorough documents. LLCs are known for their tax effectiveness. The revenues and losses of business can travel through to the individual income of the participants without undergoing company taxes, a process called pass-through tax. This means that LLCs prevent the double taxes normally seen in corporations, where both the entity and the shareholders are exhausted. It's essential for possible LLC proprietors to consult with a tax obligation expert to understand totally just how these benefits might apply to their details situations and to make sure conformity with all tax obligation obligations. In final thought, the LLC framework provides a mix of defense, tax obligation, and versatility advantages, making it a comprehensive option for local business owner who want the advantages of a firm without the formalities. Whether starting a new business or restructuring an existing one, creating an LLC might be a calculated relocate to improve functional efficiency and guard individual possessions.

Understanding LLCs: Framework, Benefits, and Factors to consider

The Restricted Obligation Company (LLC) is a preferred option amongst entrepreneurs due to its adaptable structure and protective advantages. Developed to incorporate the ideal attributes of both partnership and business structures, an LLC provides its proprietors, known as participants, with restricted liability. This implies that members are normally secured from personal obligation for service financial debts and claims, a significant benefit that helps maintain individual assets safe. In terms of taxation, an LLC is naturally versatile. Unlike a company, which undergoes corporate income tax, an LLC takes pleasure in pass-through taxes by default. Losses and earnings can be reported on the personal income tax return of the owners, potentially avoiding the double tax encountered by traditional firms. Nevertheless, if beneficial, an LLC can also elect to be taxed as a company, using flexibility relying on the monetary recommendations and objectives of its members. The operational versatility of an LLC is one more significant advantage. Unlike companies, which are called for to have a formal structure consisting of a board of supervisors and yearly meetings, LLCs do not call for such inflexible rules. Participants can develop their own rules for governance in the LLC's operating arrangement, customizing administration and earnings sharing to their particular requirements. This can be especially helpful for tiny services or startups that worth simplicity and versatility. Regardless of these advantages, there are considerations to remember. Developing an LLC involves conforming with specific state regulations, consisting of declaring write-ups of organization and paying first declaring charges, which differ from one state to another. Furthermore, while the obligation defense is significant, it is not outright. Under click through the following article , such as fraud or failure to preserve business procedures, participants could still be held directly liable. Since LLCs are relatively new, having been presented in the United States in the late 1970s, the legal criteria and analyses can differ dramatically by state. This can lead to uncertainties in exactly how some facets of LLC legislation are used, specifically when dealing with interstate company activities. Prospective LLC members should seek advice from with lawful and economic consultants to fully recognize the implications of selecting this kind of company entity for their certain scenarios.

Trick Factors To Consider for Forming an LLC

When choosing to form a Limited Liability Firm (LLC), it's necessary to think about not just the advantages but also the various duties and legal needs involved. An LLC is a preferred selection amongst business owners due to its flexibility and defense for its members versus personal obligation. The process of establishing up an LLC includes several essential steps that should be meticulously followed to ensure legal compliance and functional success. Picking an unique name for your LLC is crucial, as it needs to not just resonate with your brand yet likewise satisfy the specific identifying needs set by the state. This consists of preventing names that can puzzle your LLC with a federal government agency or that are currently being used by another signed up business. Additionally, the name normally has to include the expression “Minimal Liability Company” or among its abbreviations (LLC or L.L.C.). Once a name is picked, submitting the Articles of Company with the state is the next action. This fundamental file details the basic details of your LLC, such as its name, address, and the names of its members, and it officially registers your company with the state government. Depending on the state, you might likewise be needed to release a notice in a local newspaper about the development of your LLC, a process that assists to keep openness and public document. Additionally, preparing an operating contract is very recommended, although not always lawfully required. This inner paper outlines the governance framework and functional treatments of the LLC, outlining participant roles, electing civil liberties, earnings distribution, and other management policies, which can assist stop disagreements among participants down the line. Lastly, it's essential to recognize and abide with any type of recurring state-specific needs, such as annual coverage and tax responsibilities. These not just make certain that your LLC continues to be in excellent standing however also aid maintain the individual responsibility security that LLCs supply. Furthermore, relying on your industry, obtaining the required licenses and authorizations can be important for operating lawfully. Each of these actions needs cautious interest to detail and an understanding of the legal landscape of your service environment, making the development of an LLC a manageable but significant undertaking for prospective entrepreneur.